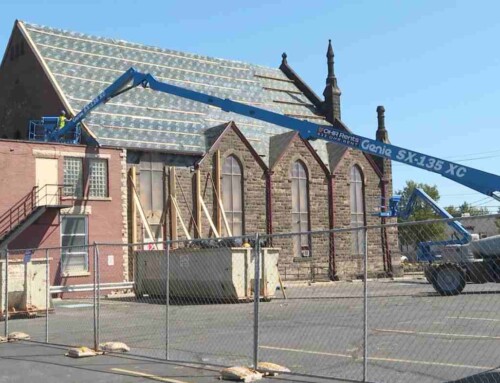

Write off equipment purchases this year – up to $1,040,000 – by taking advantage of Section 179 of the IRS code and purchasing used equipment from OHR Rents in December.

The Section 179 deduction includes new and certain used equipment – including most items sold by OHR Rents.

We are construction rental pros, so consult your tax advisor to see if a purchase will qualify.

Section 179 and used equipment

Businesses that purchase, finance or lease new or used business equipment can be eligible to take advantage of a Section 179 deduction.

- The deduction limit for 2020 is $1,040,000.

- There is a spending cap of $2,590,00 – that’s the maximum that can be spent on equipment before the deduction is reduced on a dollar-for-dollar basis.

- Equipment must be financed or purchased and put into service before 11:59 p.m. on December 31, 2020.

- Qualifying equipment must be used for business purposes more than 50% of the time to qualify for the deduction.

- More details can be found on irs.gov

Call OHR Rents today at 216-373-0854 for deals on quality used construction equipment and calculate your tax deduction on this page.